SAQ D TPSP Payment Service Providers are a subset of TPSPs specifically handling payment transactions, such as payment gateways, processors, or acquirers, and are required to comply with SAQ D. These providers are directly involved in facilitating payment card transactions on behalf of merchants.

- Eligibility Criteria: This category includes entities like payment gateways (e.g., PayPal, Authorize.net) that process transactions, fitting the broader TPSP definition but with a focus on payment processing. They must meet SAQ D eligibility, similar to other service providers, based on transaction volumes and data handling.

Compliance Requirements: They follow the same SAQ D requirements as other TPSPs, covering all PCI DSS mandates, with version 4 updates like enhanced vulnerability management and reporting. Their role in transaction processing may require additional scrutiny for data flow security.- Practical Implications: Given their direct involvement in payments, these providers are critical to the ecosystem, often requiring robust security measures like encryption and regular scans. Merchants relying on them must verify their compliance, impacting overall security.

Comparative Analysis

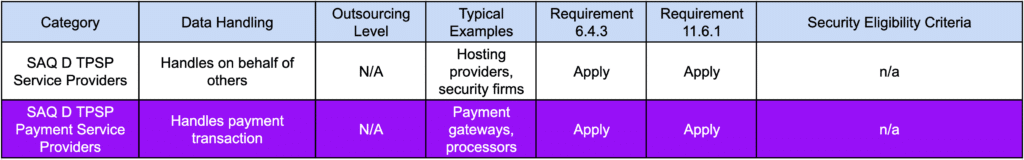

To illustrate the differences and similarities, consider the following table comparing key aspects, including the applicability of requirements 6.4.3 and 11.6.1: