Introduction: Payment Security Made Simple

For SAQ A-EP merchants, securing payment pages requires sophisticated monitoring and compliance tools. PaymentGuard offers a turnkey solution that automates these requirements, typically operational within 24-48 hours.

Immediate Protection Features:

- Browser-based script monitoring

- Real-time change detection

- Automated compliance documentation

- Instant deployment with minimal configuration

1. What is Your Business Model?

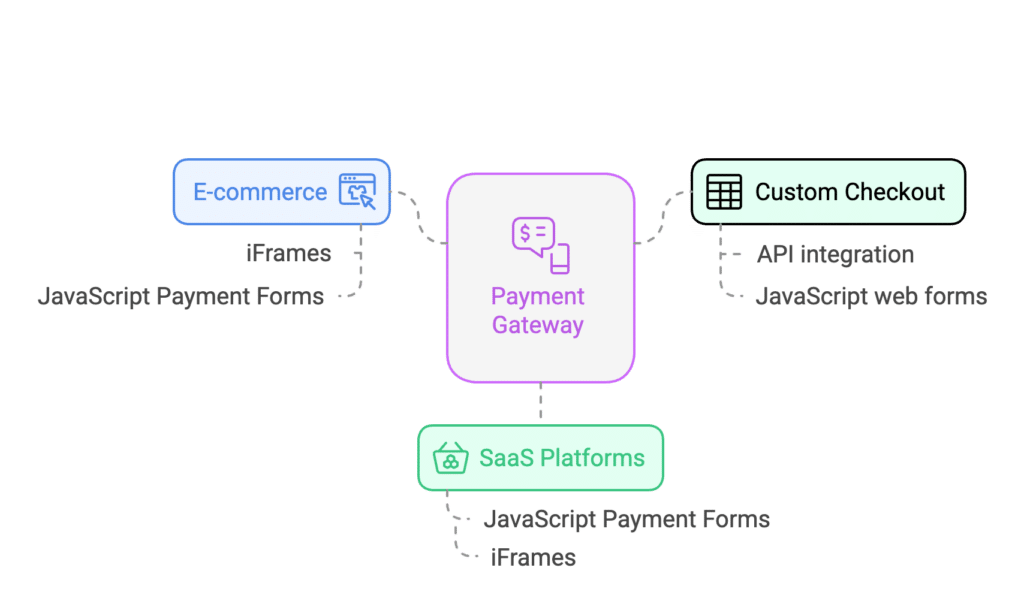

Supported Implementations:

- SaaS Platforms: JavaScript payment forms

- E-commerce: iframes and JavaScript payment forms

- Custom Checkouts: JavaScript and API-based integration

Deployment Timeline:

- Day 1: Initial setup and configuration

- Day 2: Payment page monitoring active

- Week 1: Full compliance documentation

2. Meeting PCI DSS Requirements Automatically

Requirement 6.4.3 Compliance

PaymentGuard delivers:

- Automated script inventory creation

- Real-time integrity monitoring

- Change detection and alerts

- Complete audit trails

Requirement 11.6.1 Solution

Features include:

- Continuous page monitoring

- Automated change detection

- Comprehensive documentation

- Incident response workflow

3. Script Security Through Automation

PaymentGuard Protection:

- Real-time script monitoring

- Behavioral analysis

- Integrity verification

- Automated documentation

Key Features:

- Script cataloging

- Risk assessment

- Change tracking

- Compliance reporting

4. Real-Time Change Detection

Automated Monitoring:

- Continuous page scanning

- Script behavior analysis

- Form field monitoring

- Data flow tracking

Alert System:

- Instant notifications

- Risk classification

- Response workflows

- Investigation tools

Schedule a Demo

You will see how to easily automate PCI-DSS 4.0.1 compliance for Requirements 6.4.3 and 11.6.1 in minutes.

- Autonomously and continuously maintain inventory of scripts, assure integrity, and confirm scripts are authorized.

- Automatically detect and prevent unexpected script activities.

- Get alerted of unauthorized scripts and unexpected script activities.

- Easily provide reports to your teams and QSA.

- Keep your company protected.

5. Compliance Documentation Automation

Automated Reports:

- Script inventory

- Change logs

- Compliance status

- Risk assessments

Evidence Collection:

- Automated screenshots

- Configuration records

- Change history

- Incident documentation

6. Security Monitoring Dashboard

Real-Time Visibility:

- Script activity monitoring

- Change detection

- Risk assessment

- Compliance status

Management Features:

- Custom alerts

- Team notifications

- Workflow automation

- Compliance tracking

7. Implementation Success

Quick Start:

- Account setup (Day 1)

- Initial scan (Day 1)

- Alert configuration (Day 2)

- Full protection (Week 1)

Ongoing Protection:

- Continuous monitoring

- Automated updates

- Regular compliance checks

- Documentation maintenance

8. Cost-Effective Compliance

Business Benefits:

- Reduced manual effort

- Automated compliance

- Comprehensive protection

- Simplified audits

ROI Metrics:

- 90% reduction in manual monitoring

- 24/7 automated protection

- Complete compliance documentation

- Instant threat detection

Implementation Guide

Step-by-Step Deployment:

- Initial Setup (Day 1)

- Account creation

- Basic configuration

- Initial scan

- Protection Active (Day 2)

- Monitoring enabled

- Alert setup

- Team training

- Full Compliance (Week 1)

- Custom rules

- Documentation complete

- Audit ready

Technical Integration:

- JavaScript snippet installation

- API configuration (if needed)

- Custom alert setup

- Team access configuration

PaymentGuard transforms SAQ A-EP compliance from a complex challenge into an automated, manageable process. With rapid deployment and comprehensive coverage, merchants can achieve and maintain compliance while focusing on their core business.