Being PCI DSS 4 compliant is crucial for e-commerce merchants—businesses that accept credit card payments on their websites and web applications. The new PCI DSS requirements (6.4.3 and 11.6.1) are designed to strengthen payment page security, and if you’re processing online payments, you’re likely required to comply. Compliance helps protect your customers’ sensitive payment information while ensuring the integrity and security of your payment process.

What are PCI DSS requirements 6.4.3 and 11.6.1 ? Let’s break them down what you actually have to do:

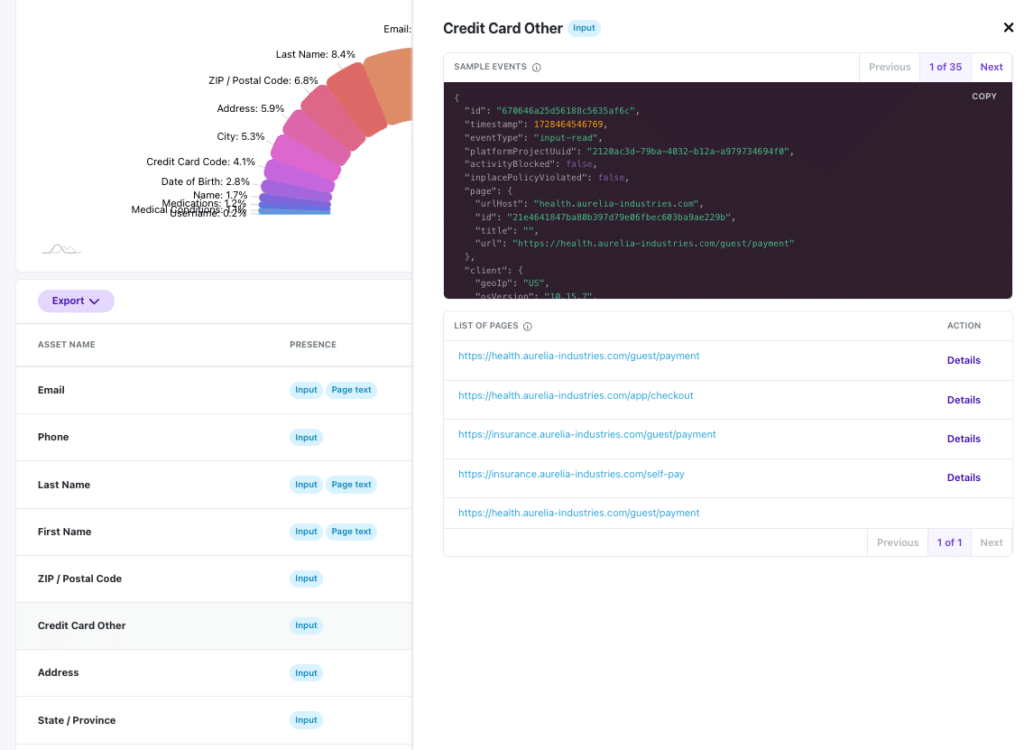

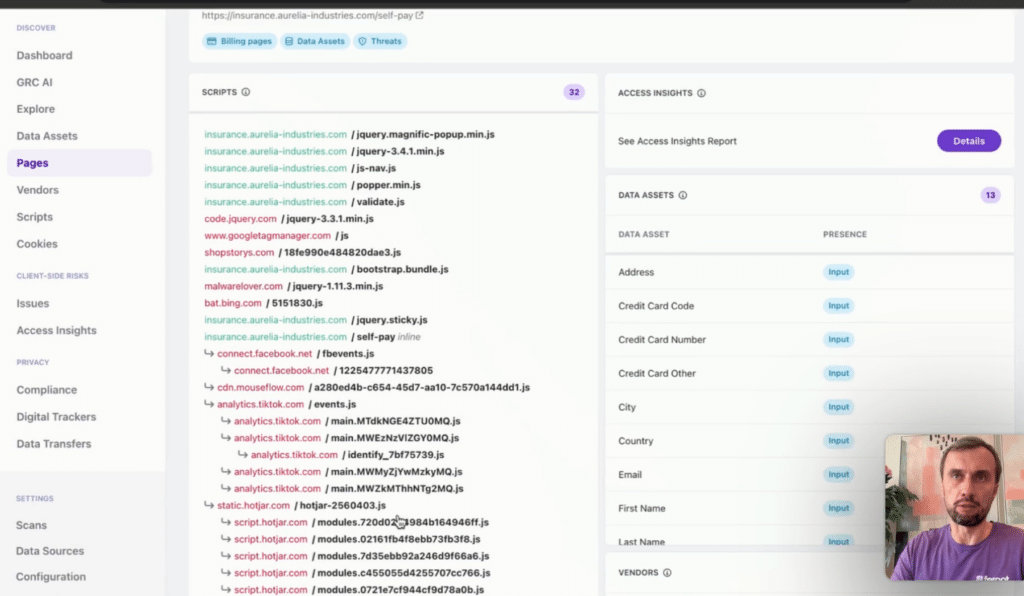

- Track Inventory of All Scripts: You need to keep an inventory of all scripts on payment pages, including those in Single Page Applications (SPAs).

- Ensure Script Integrity: Every script must be validated for integrity to ensure it hasn’t been tampered with.

- Authorize and Justify Scripts: Only authorized scripts should be present, and you need proof explaining why each script is necessary.

- Detect and Respond to Unauthorized Changes: Quickly identify and respond to any unauthorized changes in script or page content.

- Prevent Unauthorized Script Activities: Prevent scripts from unauthorized access to sensitive information or modifying page content.

These might sound overwhelming, but with Feroot, complying with PCI DSS is made simple.

How Feroot Helps You Comply in Minutes?

Feroot takes the complexity out of compliance by automating the entire process. Here’s how easy it is to meet PCI DSS 4 requirements with Feroot:

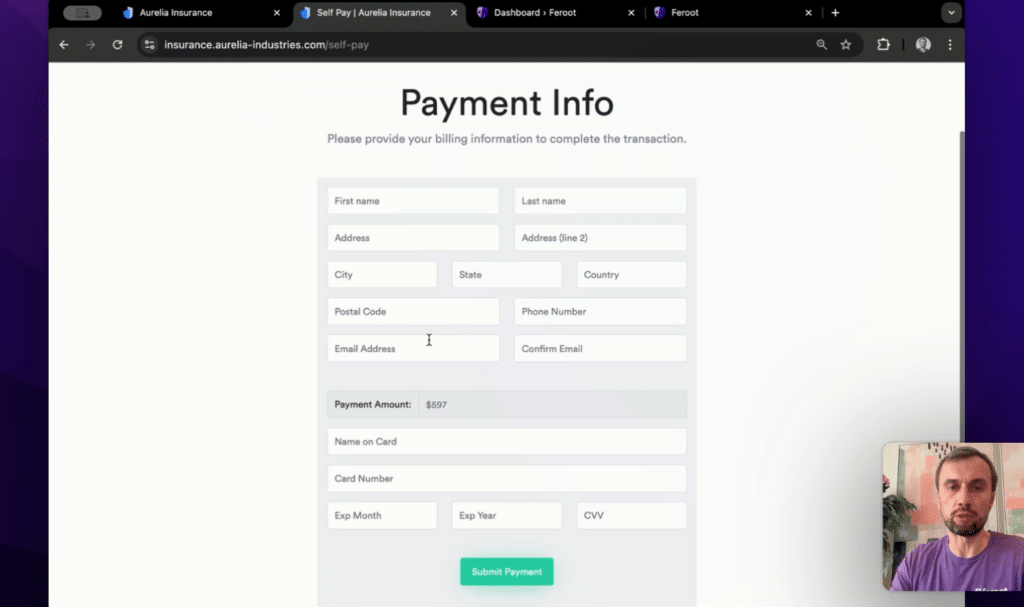

- Start with Just a URL: Begin by entering your payment page’s URL. Feroot AI simulates real user interactions, providing complete visibility into every script running on your payment page.

- Automated Script Discovery and Storage: Feroot automatically discovers all scripts, including those within dynamic and conditional forms, across different user flows.

- Automated Authorization: Review and confirm the authentication and justification for each script, ensuring that only necessary scripts are in use.

- Automated Prevention of Unauthorized Activities: You can set rules to prevent unauthorized script actions, such as accessing user input fields or loading unapproved scripts.

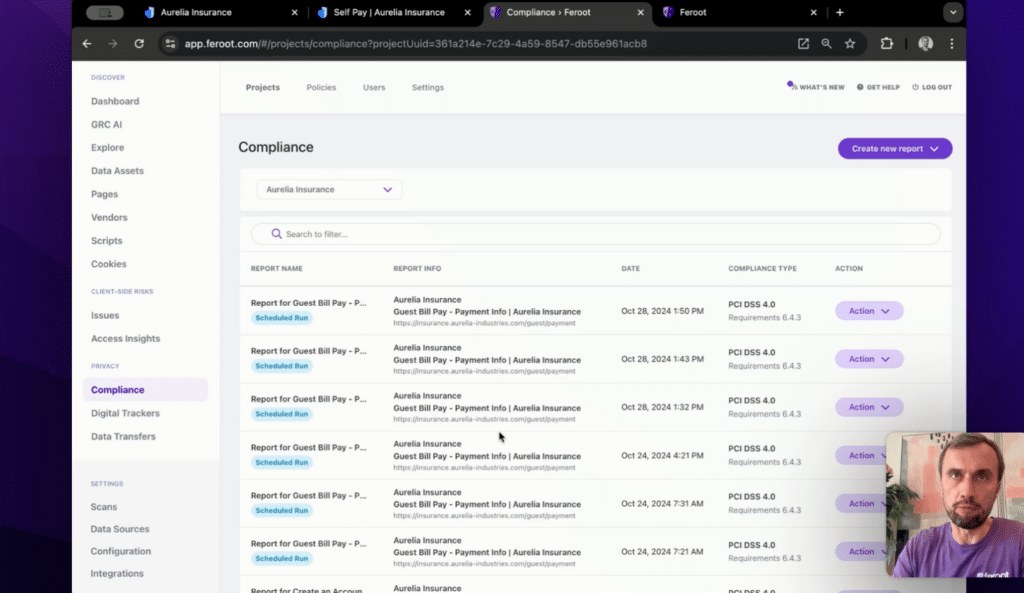

- Continuous Reporting: Compliance reports are generated daily, weekly, or bi-weekly—whichever fits your needs—making audit preparation stress-free.

With Feroot, compliance becomes a breeze. Your payment pages are continuously monitored and secured, giving you peace of mind that you’re always ready for audits and protecting your customers’ sensitive payment information.

The Benefits of Using Feroot for PCI DSS Compliance

- Total Visibility: Track inventory of all scripts on payment pages effortlessly.

- Simplified Integrity Checks: Ensure script integrity and security with ease.

- Ready for Audits: Generate continuous compliance reports exactly the way auditors love them—clear, comprehensive, and up-to-date.