PCI DSS 4.0.1 Compliance for Payment Providers (SAQ D) – How to Ensure Compliance Across Thousands of Payment Pages

1. Introduction

Compliance for Payment Providers SAQ D presents unique challenges due to their distributed business model. With payment pages, iframes, and forms embedded across thousands of merchant websites, ensuring consistent security and maintaining PCI DSS 4.0.1 compliance requires sophisticated solutions and strategies.

2. The Payment Provider Business Model and Its Compliance Challenges

Payment providers operate in a complex ecosystem where their payment solutions are integrated into numerous merchant websites. This distributed model creates significant challenges for maintaining security and compliance, particularly when managing:

- Embedded payment forms

- Hosted payment pages

- iFrame implementations

- JavaScript-based payment solutions

3. PCI DSS 4.0.1 Key Compliance Requirements for Payment Providers

Service providers must pay particular attention to two critical requirements:

- Requirement 6.4.3: Managing payment page scripts

- Requirement 11.6.1: Detecting unauthorized changes

4. Understanding PCI DSS Requirement 6.4.3

Payment providers must secure JavaScript and third-party scripts across their entire merchant network. This includes:

- Maintaining an inventory of approved scripts

- Implementing robust security controls

- Monitoring for unauthorized changes

How Feroot PaymentGuard Helps:

- Automatically inventories all payment page scripts

- Provides real-time script monitoring

- Implements automated script integrity verification

- Maintains comprehensive audit trails

5. Understanding PCI DSS Requirement 11.6.1

Change detection for payment pages is crucial for preventing tampering and attacks.

PaymentGuard’s Solution:

- Real-time monitoring of payment page content and HTTP headers

- Automated detection of unauthorized modifications

- Instant alerts for suspicious changes

- Comprehensive audit trails across all merchant implementations

6. The Compliance Strategy for Thousands of Unique Payment Pages

PaymentGuard enables payment providers to:

- Implement standardized security policies

- Automate compliance enforcement

- Monitor third-party risks

- Maintain consistent security controls

Schedule a Demo

You will see how to easily automate PCI-DSS 4.0.1 compliance for Requirements 6.4.3 and 11.6.1 in minutes.

- Autonomously and continuously maintain inventory of scripts, assure integrity, and confirm scripts are authorized.

- Automatically detect and prevent unexpected script activities.

- Get alerted of unauthorized scripts and unexpected script activities.

- Easily provide reports to your teams and QSA.

- Keep your company protected.

7. Maintaining PCI DSS Compliance at Scale

PaymentGuard offers:

- Centralized compliance management

- AI-powered continuous monitoring

- Automated periodic compliance audits

- Detailed compliance reporting

- Historical compliance records

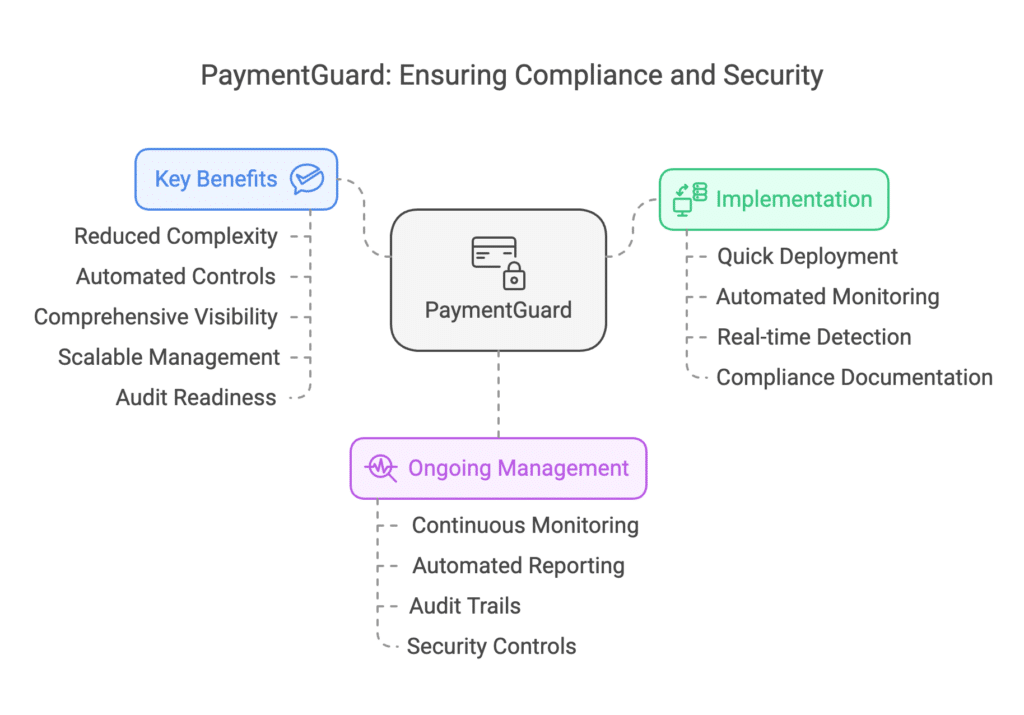

8. Avoiding Compliance Pitfalls

PaymentGuard helps prevent common issues by:

- Implementation:

- Quick deployment across merchant networks

- Automated script inventory and monitoring

- Real-time change detection

- Comprehensive compliance documentation

- Ongoing Management:

- Continuous monitoring and alerts

- Automated compliance reporting

- Historical audit trails

- Scalable security controls

- Key Benefits:

- Reduced compliance complexity

- Automated security controls

- Comprehensive visibility

- Scalable compliance management

- Complete audit readiness

Feroot PCI PaymentGuard provides payment service providers with a comprehensive solution for managing PCI DSS 4.0.1 compliance across thousands of merchant implementations. By automating critical security controls and providing robust monitoring capabilities, PaymentGuard enables payment providers to maintain consistent compliance while supporting business growth.

To learn more about how PaymentGuard can help your organization maintain PCI DSS compliance at scale, contact Feroot Security for a demonstration of our solution’s capabilities.